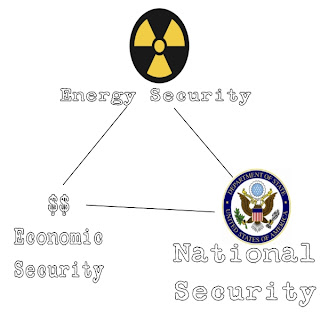

This is the Third Part of the Series on Energy Security.

Part III

What is the Cost of Energy Security?

Most of us realize the cost of energy. We see it when we put gas in our vehicle, or pay our power bill. The cost to us, and its effect on our economy does not stop there. Everything you come in contact with has an energy cost. To understand these costs we will focus on Oil as an energy source.

At the time of this blog being written the cost of a 42 gallon barrel of oil was $98. From a average barrel of oil you will, through the fractioning process, get about 19 gallons of gasoline. Do the math..Cost per gallon=$98 per barrel/42 gallons in a barrel. Cost per gallon $2.33. Keep in mind this is pre-production cost...nothing has been refined yet. Refining adds another $.50 per gallon...which brings us up to $2.83 per gallon. Of course there is a tax with that.

Federal Taxes are a flat 18.4 cents per gallon. State, and local taxes are highly variable based on where you are. In Florida the total in taxes is 38.4 cents per gallon. That now makes the price of one gallon of gas $2.90 per gallon. Of course the company that refines the gasoline must transport it to the pump, advertise it, pay employees etc...this adds another 29 cents per gallon. Leaving us with a flat cost of $3.19 per gallon. At present, (20 September, 2012) the cost of gas at my local station was $3.70 per gallon. That would mean the gas companies are making 50 cents on every gallon...right?

Not so right...that 50 cents does not account for other taxes (income, property, etc). This is where things get difficult to track on a per gallon basis. The other factors that affect cost at the pump are so highly variable that it becomes nearly impossible to accurately track..so that this point I must make an educated guess.

In 2007 Exxon's stated after tax earnings were 10.4 percent. That is higher than the industries average earnings for that year of 8.3%. Those numbers are after-tax income. To make maters worse those earnings include the sales of non-gasoline items. Yes..those $2 Twinkies add to the company's profits.

In the retail world (and you are buying gas at retail prices) the cost of an item already includes all of the associated expenses. This includes the actual cost of an item, advertising, employees, sales space, and other operating taxes. Then they bump that to "what the market can bear" or what is commonly known as the markup. Jeans for instance carry a markup of 100% to 350%. Now lets say that your local gas station shoot for Exxon's 10.4% profit. It would appear that the sale of Jeans is much more of a greed issue, than the sale of gasoline.

But what about the base cost of $98 per barrel of oil? Where does that come from? We have all heard of the theory of supply and demand. The greater the supply and the less the demand the less money something is worth...and the inverse is true as well. There is another factor at play...Market Sentiment. There is a mistaken belief that investors in oil control the price as part of a grand conspiracy. There is some truth to that...but that is something to be discussed a bit later.

The way most people invest in oil is by investing in the oil company. This has no impact on the cost of oil one way or the other. The oil companies profit as we described is not just from oil, but from all of the other products they sell as well. However, there is a special group of investors, and they do affect the price of oil. They are called Futures Investors.

Futures investments mean that a purchaser agrees to pay a particular price for a product on a specific date. This is an extremely important method of investing since it allows a company to plan for a rise, or drop in prices of a particular product. Futures investors come in two flavors...the Hedger..and the Speculator.

An example of a Hedger would be an airline. They buy oil based on a set price. This protects them from unexpected hikes in price that would affect the cost of their business. A Hedger intends on actually buying the oil.

A speculator is a totally different animal. They use guesses (educated sometimes) to determine what the price of oil will be at a future date. They have no intention of buying the actual product. This type of investing can be a roller coaster to doom, or a ride to great wealth. And the determining factor in both is Market Sentiment.

The mere belief that oil prices will rise..or fall is enough to result in the immediate increase, or drop in prices. This is like letting your cat play the piano...he might hit some comforting notes...but he is just as likely to drive you nuts.

Although Futures Investors play a significant part in the price of oil world wide, there is of course OPEC. The Organization of Petroleum Exporting Countries is the largest organization that controls the price of oil. The list of member countries in OPEC reads like a Who's Who of unstable dictatorships, and theological opposites of the western world. But there is a symbiotic relationship. OPEC needs the money from the industrialized nations of the west to survive, and the west needs the OPEC to continue forward. Or so they want you to believe. As much as I would love to jump into that discussion right now...it will be saved for the next installment of this series.

References

http://www.api.org/News-and-Media/docs/Testimony-Archive.aspx

http://www.oil-price.net/

http://www.floridastategasprices.com/Tax_Info.aspx

http://www.wisebread.com/cheat-sheet-retail-markup-on-common-items

http://www.investopedia.com/articles/economics/08/determining-oil-prices.asp#axzz26zrfE0H0

http://www.opec.org/opec_web/en/press_room/178.htm

At the time of this blog being written the cost of a 42 gallon barrel of oil was $98. From a average barrel of oil you will, through the fractioning process, get about 19 gallons of gasoline. Do the math..Cost per gallon=$98 per barrel/42 gallons in a barrel. Cost per gallon $2.33. Keep in mind this is pre-production cost...nothing has been refined yet. Refining adds another $.50 per gallon...which brings us up to $2.83 per gallon. Of course there is a tax with that.

Federal Taxes are a flat 18.4 cents per gallon. State, and local taxes are highly variable based on where you are. In Florida the total in taxes is 38.4 cents per gallon. That now makes the price of one gallon of gas $2.90 per gallon. Of course the company that refines the gasoline must transport it to the pump, advertise it, pay employees etc...this adds another 29 cents per gallon. Leaving us with a flat cost of $3.19 per gallon. At present, (20 September, 2012) the cost of gas at my local station was $3.70 per gallon. That would mean the gas companies are making 50 cents on every gallon...right?

Not so right...that 50 cents does not account for other taxes (income, property, etc). This is where things get difficult to track on a per gallon basis. The other factors that affect cost at the pump are so highly variable that it becomes nearly impossible to accurately track..so that this point I must make an educated guess.

In 2007 Exxon's stated after tax earnings were 10.4 percent. That is higher than the industries average earnings for that year of 8.3%. Those numbers are after-tax income. To make maters worse those earnings include the sales of non-gasoline items. Yes..those $2 Twinkies add to the company's profits.

In the retail world (and you are buying gas at retail prices) the cost of an item already includes all of the associated expenses. This includes the actual cost of an item, advertising, employees, sales space, and other operating taxes. Then they bump that to "what the market can bear" or what is commonly known as the markup. Jeans for instance carry a markup of 100% to 350%. Now lets say that your local gas station shoot for Exxon's 10.4% profit. It would appear that the sale of Jeans is much more of a greed issue, than the sale of gasoline.

But what about the base cost of $98 per barrel of oil? Where does that come from? We have all heard of the theory of supply and demand. The greater the supply and the less the demand the less money something is worth...and the inverse is true as well. There is another factor at play...Market Sentiment. There is a mistaken belief that investors in oil control the price as part of a grand conspiracy. There is some truth to that...but that is something to be discussed a bit later.

The way most people invest in oil is by investing in the oil company. This has no impact on the cost of oil one way or the other. The oil companies profit as we described is not just from oil, but from all of the other products they sell as well. However, there is a special group of investors, and they do affect the price of oil. They are called Futures Investors.

Futures investments mean that a purchaser agrees to pay a particular price for a product on a specific date. This is an extremely important method of investing since it allows a company to plan for a rise, or drop in prices of a particular product. Futures investors come in two flavors...the Hedger..and the Speculator.

An example of a Hedger would be an airline. They buy oil based on a set price. This protects them from unexpected hikes in price that would affect the cost of their business. A Hedger intends on actually buying the oil.

A speculator is a totally different animal. They use guesses (educated sometimes) to determine what the price of oil will be at a future date. They have no intention of buying the actual product. This type of investing can be a roller coaster to doom, or a ride to great wealth. And the determining factor in both is Market Sentiment.

The mere belief that oil prices will rise..or fall is enough to result in the immediate increase, or drop in prices. This is like letting your cat play the piano...he might hit some comforting notes...but he is just as likely to drive you nuts.

Although Futures Investors play a significant part in the price of oil world wide, there is of course OPEC. The Organization of Petroleum Exporting Countries is the largest organization that controls the price of oil. The list of member countries in OPEC reads like a Who's Who of unstable dictatorships, and theological opposites of the western world. But there is a symbiotic relationship. OPEC needs the money from the industrialized nations of the west to survive, and the west needs the OPEC to continue forward. Or so they want you to believe. As much as I would love to jump into that discussion right now...it will be saved for the next installment of this series.

Part III

Summary

You have learned the reason gasoline costs what it does. The fact that nothing in this nation moves without it has been a fact since the invention of the internal combustion engine. In the days before the train goods were moved by horses. A horse could move twice its weight 30 miles per day. So if you wanted a nice orange from Tampa, it would take 25 days to have it transported to North Carolina. In that time..it would not be so nice. Prior to the invention of the train your food had to be locally grown. A train can move that orange in less than 12 hours. Add refrigeration and you can get fresh orange juice year round.

Look around your home...everything there is tied to the price of oil. For manufacturers of goods, energy is a prime consideration in what you pay for those goods. I have watched those shows were people get "back to nature". They brag about their independence from the normal world...while they cut wood with an iron axe. That iron was mined using modern methods of digging. It was smelted in large furnaces fired by coke (a coal derivative). It was transported to the store by truck or train using petroleum products. The people who mined the ore, smelted it, and eventually sold it..all used Oil to survive their day. Try as you might...oil is a requirement.

The Cost imposed by Government equates to 56.4 cents on every gallon of gas sold in Florida (86.9 cents in California) compare that to the before tax profit of the Oil company of 50 cents and it is clear that the entity that profits the most is the Government.

Most of the argument about Oil comes from those who dislike big oil companies (I call that jealousy) and the environmentalists (I normally write that environMentalists). As far as big oil goes...they profit no where as much as the Government..and they take all the risk. In the pricing scheme the post Oil per barrel cost is peanuts compared to what the raw product costs.

The next installment in this series will deal with the issue of how we can become independent of outside influences in creating Energy Security.

http://www.api.org/News-and-Media/docs/Testimony-Archive.aspx

http://www.oil-price.net/

http://www.floridastategasprices.com/Tax_Info.aspx

http://www.wisebread.com/cheat-sheet-retail-markup-on-common-items

http://www.investopedia.com/articles/economics/08/determining-oil-prices.asp#axzz26zrfE0H0

http://www.opec.org/opec_web/en/press_room/178.htm